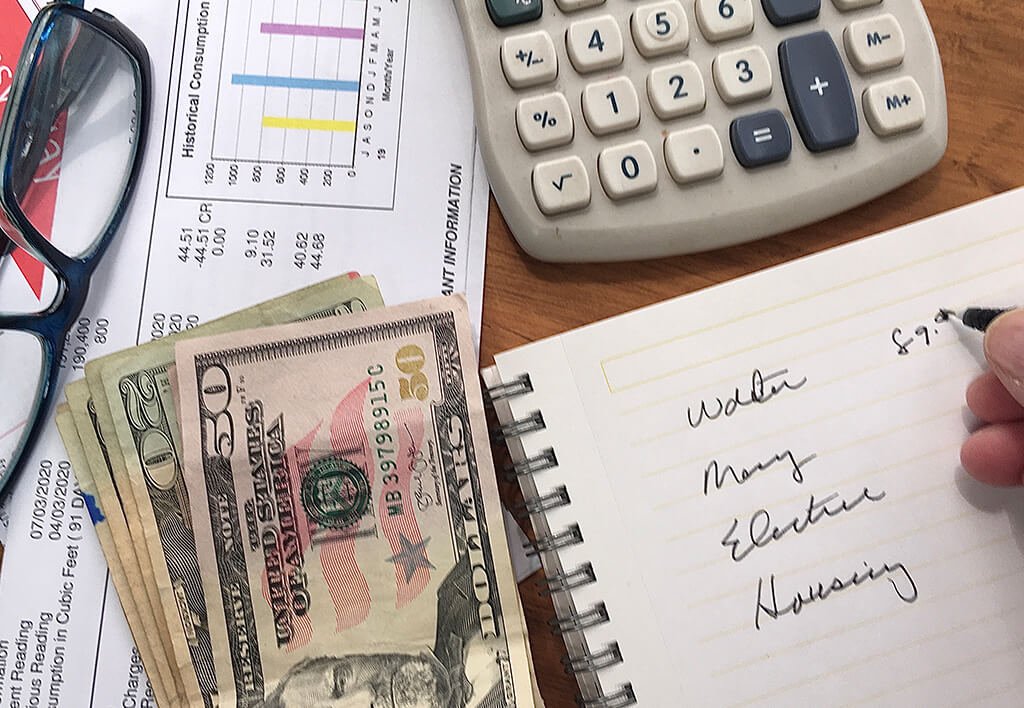

Updated January 20, 2025 – A student’s search for their first apartment can be quite daunting, especially when prospective landlords conduct stringent interviews. Verifiable income proof is required when renting an apartment. It means that you need to provide credible evidence proving that you can financially support your bills as well as your rent and utility expenses. For college going students, parents might have to provide a declaration stating they accept financial responsibility should the student fail to pay.

What Is Proof of Income?

Proof of Income refers to documents identifying one’s income obtained from an employer or a business that pays for their service or records income attributed to the individual with a financial institution where it is deposited for tax or other non-business purposes. There are different forms of income proof documentation with each having its own attributes. The goal is using those documents that accurately portray one’s entire income in a week, month, or year.

Why is it Important for Landlords?

In order to earn profit, a landlord must own property. While they are renting you out an apartment, most of them will require some income verification as part of the application process. Proof of income verification indicates that you can financially pay for the rent, utilities, and various other bills. If you fail to pay rent, it would indeed cost the landlord to evict you. In every sense, a landlord would rather prefer you renting the apartment and making payments which is of course financially beneficial for everyone.

Acceptable Proof of Income Documents: What Are They?

Verification of income can be performed in numerous ways. The popularly accepted methods include pay stubs and bank statements, but there are others. Some include:

- Tax returns

- Worker’s compensation letter

- W-2 income statement

- Annuity statement

- Statement of Social Security benefits

- 1099 form

- Court ordered awards letter

- Pension distribution statement

A rule of thumb to keep in mind when calculating how much rent you can afford is about 30 percent or less of your total income. If you have any concerns about what proof of income documentation your landlord needs, it is best that you approach them. With regards to proof of income apartments, most are not very difficult as long as they receive an adequate measure of your financial standing.

Most times, renting out an apartment is a straightforward procedure provided you have the needed information ready in advance of filling out the forms. You will want to reach out to your employer and bank and request that they print out the information you will need. Provided you are somewhat organized, you just need to print copies of the most recent pay stubs, bank statements, or other relevant documents for a period of two to three months and you’ll be ready to go.